Investing in gold has always been a popular strategy for securing wealth, protecting against inflation, and diversifying an investment portfolio. With 2025 approaching, gold presents even more compelling reasons for investors to make it part of their strategy. In this article, we’ll explore why now is a prime time to invest in gold in 2025, the factors influencing its potential growth, and how it can help safeguard financial stability.

Why Choose to Invest in Gold in 2025?

Investing in gold has long been valued as a hedge against economic downturns, currency devaluation, and inflation. For centuries, gold has remained a reliable store of value, providing investors with security in uncertain times. As we approach 2025, a combination of global economic factors is setting the stage for what could be a lucrative year for gold investments.

Invest in gold in 2025 to protect your portfolio as global financial trends signal potential volatility in traditional assets. From inflation to geopolitical tensions, several factors point toward an increase in gold demand, making it a wise choice for risk-averse investors looking for stability and long-term value.

The Economic Landscape of 2025: Gold’s Role as a Safe Haven

The current economic climate is complex. With inflation rates still high in many countries, ongoing trade disputes, and fluctuations in stock and bond markets, 2025 is likely to bring continued volatility to traditional assets. For these reasons, experts project that many will seek to invest in gold in 2025 as a safe haven. Here’s why:

- Inflation and Currency Devaluation

Central banks around the world have been increasing interest rates to curb inflation, but this process is gradual and not always effective in the short term. Meanwhile, currency values are fluctuating, and gold has a long history of maintaining value, even as currencies lose purchasing power. By choosing to invest in gold in 2025, you can hedge against inflation and protect the real value of your wealth. - Global Uncertainty and Geopolitical Tensions

Geopolitical tensions can cause sudden shifts in the global economy, disrupting markets and impacting investments. Gold is considered a “safe haven” asset precisely because it holds its value when other assets falter. In 2025, with potential for continued political shifts and conflicts, those who invest in gold are positioned to avoid some of the economic turmoil these situations can cause. - Stock Market Volatility

Stocks remain an essential part of many portfolios, but 2025 could be a year marked by increased volatility. For those seeking stability amid market ups and downs, choosing to invest in gold in 2025 is a way to ensure some balance. Gold prices often increase when stock markets decline, providing a form of insurance for traditional portfolios.

Benefits of Gold as a Long-Term Investment in 2025

Gold offers more than just short-term stability; it’s a proven long-term investment vehicle. Here’s why 2025 is an excellent time to consider it:

- Preservation of Wealth

Gold has consistently preserved wealth through different eras, making it an attractive option for investors focused on the long-term value of their assets. Unlike fiat currencies, gold’s value doesn’t erode over time due to inflation, which is another reason many are looking to invest in gold in 2025. - Diversification

Gold is known for its ability to diversify portfolios and reduce risk. By allocating a portion of your portfolio to gold, you protect it from systemic risks that impact stocks, bonds, and other conventional assets. - Liquidity

Gold is highly liquid, meaning it can be quickly converted into cash if needed. Whether you buy physical gold or invest in gold ETFs, having a liquid asset is essential for financial security, especially during unpredictable times. This liquidity makes it easy to invest in gold in 2025 while still maintaining access to your assets when you need them.

Ways to Invest in Gold in 2025

There are various ways to invest in gold in 2025 depending on your goals and risk tolerance. Here are some of the most common methods:

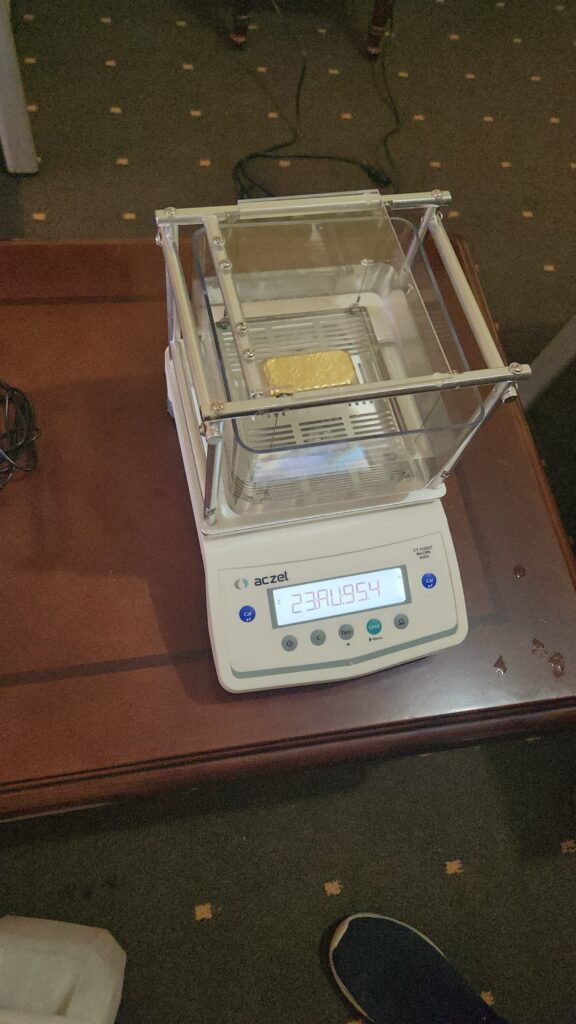

- Physical Gold (Bars and Coins)

Physical gold is an ideal choice for those who want tangible assets. Gold bars and coins offer direct ownership of gold and can be stored securely for future sale. Many investors prefer physical gold for its tangible, lasting value. - Gold ETFs and Mutual Funds

For those looking to avoid storage concerns, gold-backed exchange-traded funds (ETFs) and mutual funds provide an alternative. They allow you to invest in gold indirectly while maintaining liquidity and reducing the hassle of storage. - Gold Mining Stocks

Some investors choose to invest in gold mining stocks or gold-related companies. While not a direct investment in gold, these stocks can perform well when gold prices rise. However, they come with higher risk than physical gold or ETFs due to company performance factors.

Why Demand for Gold is Set to Increase in 2025

Demand for gold has been rising globally due to economic and political uncertainties, especially in countries with high inflation and currency instability. As demand increases, supply struggles to keep up, leading to upward pressure on prices. This trend is expected to continue into 2025, making it a lucrative time to invest in gold.

Emerging markets, like China and India, where gold is both a traditional and investment asset, continue to drive demand. Additionally, central banks have been increasing their gold reserves to protect against future economic downturns. This level of demand further solidifies why 2025 could be an excellent year to invest in gold.

Final Thoughts: Why You Should Invest in Gold in 2025

In summary, the global economic outlook, coupled with gold’s unique advantages as a safe haven asset, makes investing in gold in 2025 a wise decision. Gold not only serves as a hedge against inflation but also provides stability during times of economic uncertainty and market volatility. Whether you choose physical gold, gold ETFs, or mining stocks, having gold in your portfolio can add a layer of security that few other assets can match.

With demand projected to increase and economic instability likely to continue, now is the perfect time to explore your options and invest in gold in 2025. At Midas Africa Gold Co., we provide high-quality gold products and services to meet your investment needs. Get in touch today to start securing your financial future through gold investment.

Current Gold Price

Related: The Best Competitive 24k Gold Prices

Related: Buy Gold Bullion from Uganda at the Best Rates

Related: The Best Price for 18K Gold

Why should I invest in gold in 2025?

Investing in gold in 2025 is a smart choice because gold serves as a hedge against inflation, offers stability during economic uncertainty, and is expected to see strong demand, potentially driving prices higher.

What are the best ways to invest in gold in 2025?

The best ways to invest in gold include purchasing physical gold (bars or coins), investing in gold ETFs or mutual funds, or buying stocks in gold mining companies, each offering unique advantages depending on your investment goals.